Recent financial reports indicate that big investors buy European bonds, speculating about forthcoming cooler inflation. Meanwhile, they have sold US Treasuries, hoping the European central bank will start cutting interests sooner than the Fed.

Eurozone Bond Market Hike Overview

T Rowe Price, JPMorgan, and Pimco recently raised their European government bonds. This move hiked the gap between the benchmark 10-year US & German borrowing costs. In any case, the gap rose to 2% points to attain its highest level since November.

JPMorgan’s global head of fixed income & chief investment officer, Bob Michele, explained that Europe expects rate cuts sooner than the US. Bob said it is hard for the Federal Reserve to give an economic indicator to cut rates. In addition, he noted that JPMorgan Asset Management holds unusually large European government bonds.

Pimco global fixed income chief investment officer Andrew Balls says he favors UK gilts and European government bonds over US treasuries in 2024. Overall, he explained that the UK and European economies showcase more stamina on ‘inflation correcting.’ The company lowered its forecast to a two-quarter-point rate this year.

Why Do Big Investors Buy European Bonds?

The update comes amid diverging European and US economies with weaker economies and softer inflation. But what are the leading causes of these trades?

-

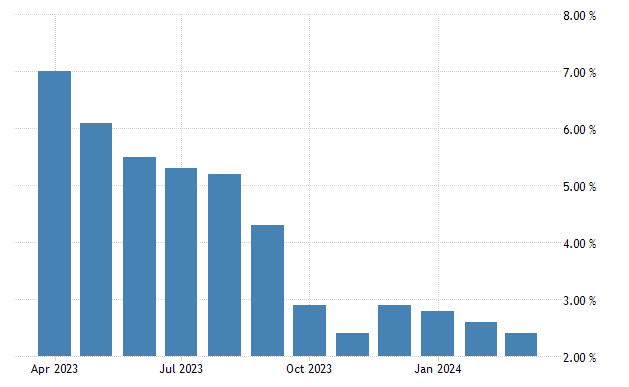

Cooler Inflation

Analysts predicted a 3.4% increase in March US inflation data. Nonetheless, previous readings for February and January were higher than analysts’ expectations. On the other hand, the Eurozone inflation rate dropped to 2.4% in March, fueling expectations for interest rate cuts since it was lower than the forecast.

- Economic Divergence

T Rowe Price senior managers prefer to buy Eurozone government bonds and remain underweight in United States Treasuries. In general, analysts say the European Central Bank will cut interest rates faster than the Federal Reserve. The resulting rates will likely lower the hedging costs for Eurozone government bonds than US Treasuries.

- Market Expectations

Markets now expect three or four borrowing cost cuts by the end of 2024 in Europe and two or three cuts in the United States. In any case, the US and Eurozone government bonds have sold off in 2024 to push yields higher as investors predict rate cuts.

Big Investors Buy European Bonds Aftermath

Europe showcases a more open economy than the US, with less fiscal impulse and more sensitivity to global manufacturing. Some analysts predict that the US will incur a deficit. Here are the likely impacts as big investors buy European bonds.

-

Bond Yields

Bond yield impacts are more significant in the United States since the benchmark Treasury yield rose to 4.4% from 3.9%. On the other hand, the equivalent German Bund rose to 2.4% from 2.1%. The US total revenue and expenditure difference will be 8.1% of the GDP in 2024. Yet, Germany will record a 1.4% difference in revenue & expenditure.

- Potential Risks

Markets analysts warn that if the European Central Bank raises rate cuts way ahead of the Federal Reserve, it could weaken the Euro and increase inflation. Barclays Head of Global Inflation Research Mike Pond explained that the move could result in a significant currency impact and divergence. Thus, it is hard for the ECB to cut rates.

Wrapping Up!

It is evident that big investors buy European bonds and are reluctant to invest in US Treasuries. Yet, the risks involved with raising interest rate cuts earlier than the Fed can be impactful. Thus, the European Central Bank is keen to make the right decision.