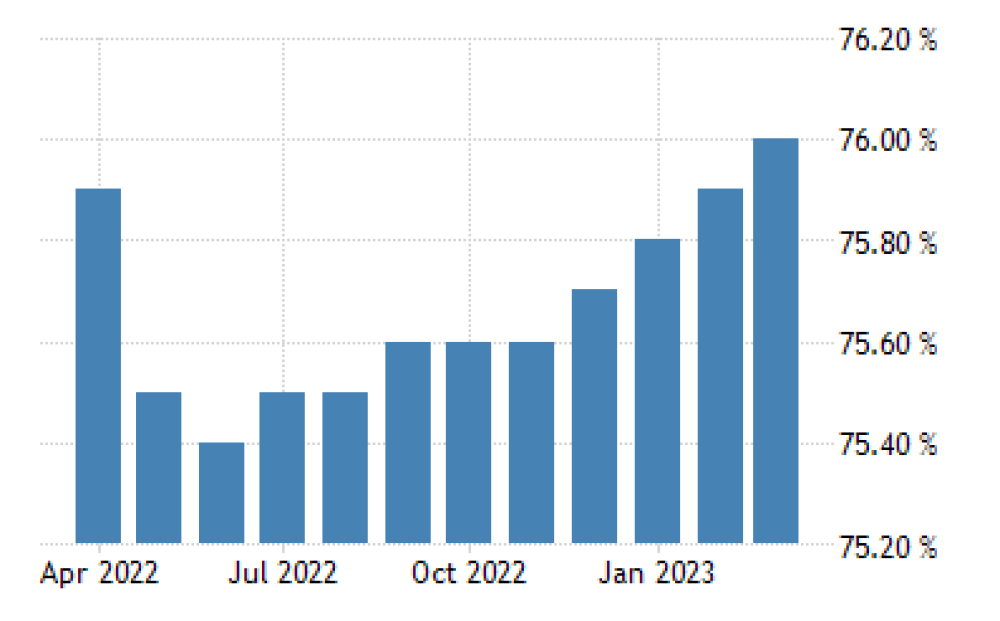

The UK unemployment rate fell while wages rose unexpectedly in April. These updates indicate Britain’s resilient economy defies efforts to dampen inflation pressure and control demand. Although analysts had forecasted a 4% increase in the unemployment rate, it dropped in three months through April to 3.8%. The Office of National Statistics also announced that the average earnings rose. The average earnings hit the highest level since the pandemic.

After the data release, most traders felt convinced that the Bank of England would likely raise interest rates again amid its upcoming Monetary Policy Committee. They believe a 1.25 basis points hike to 5.75% would occur this year and a possible 6% by February next year. In any case, the BoE will likely raise the interest rate by 50 basis points this month. The 2-year government notes yield rose while the short-term bonds tumbled. The 2-year note also hit its highest level in April since the 2008 financial crisis.

Meanwhile, the BoE and economists find the new figures surprising since they expected the 12 consecutive interest rate hikes to loosen the labor market. But wages are rising due to a persistent worker shortage since many resigned from the workforce during the Covid-19 pandemic. The unemployment number surpassed the pre-pandemic record after increasing to 33.1 million for the first time. Yet, other Group of Seven countries hit this milestone a few months ago.

In simple words, UK companies struggled with the unemployment rate, bidding up pay, and finding staff. The workers' shortage is on the pay scale’s both ends, including high-tech jobs like IT and Finance. Other positions that European Union migrants filled, like leisure & hospitality, are also facing shortages. Overall, the UK number of employed people rose by 94,000 amid a 13,000 fall in the number of inactive people and a 25,000 decrease in unemployment.

Despite the Russia-Ukraine war, Covid-19, and Brexit shocks, the UK economy rose slowly, leading to analysts ruling out a recession. The BoE has clarified that the workers' shortage could cause inflation pressures, requiring more interest rate hikes. Jeremy Hunt vowed to lower the inflation rate and boost consumers spending power to bring down the cost of living. Besides hurting people’s paychecks, the soaring inflation squeezed household living standards.

All in all, the global market could face the worst industrial strife from the 1980s after real wages remained 1.3% lower than in 2022. Above all, the number of payroll employees increased to 22,879 in May. The ONS also revised the payrolls decline in April, replacing it with a 6,822 rise. Analysts believe the Bank of England will continue raising the borrowing costs throughout the summer, starting with an increase to 4.75% on 22nd June. This rise would mark the highest rate in ten years since the beginning of the global financial crisis.